Apply Now to See If You Qualify by CLICKING HERE

Did You Apply for the ERTC Yet? Dance Studio Owners get some of your Hard earned cash back!

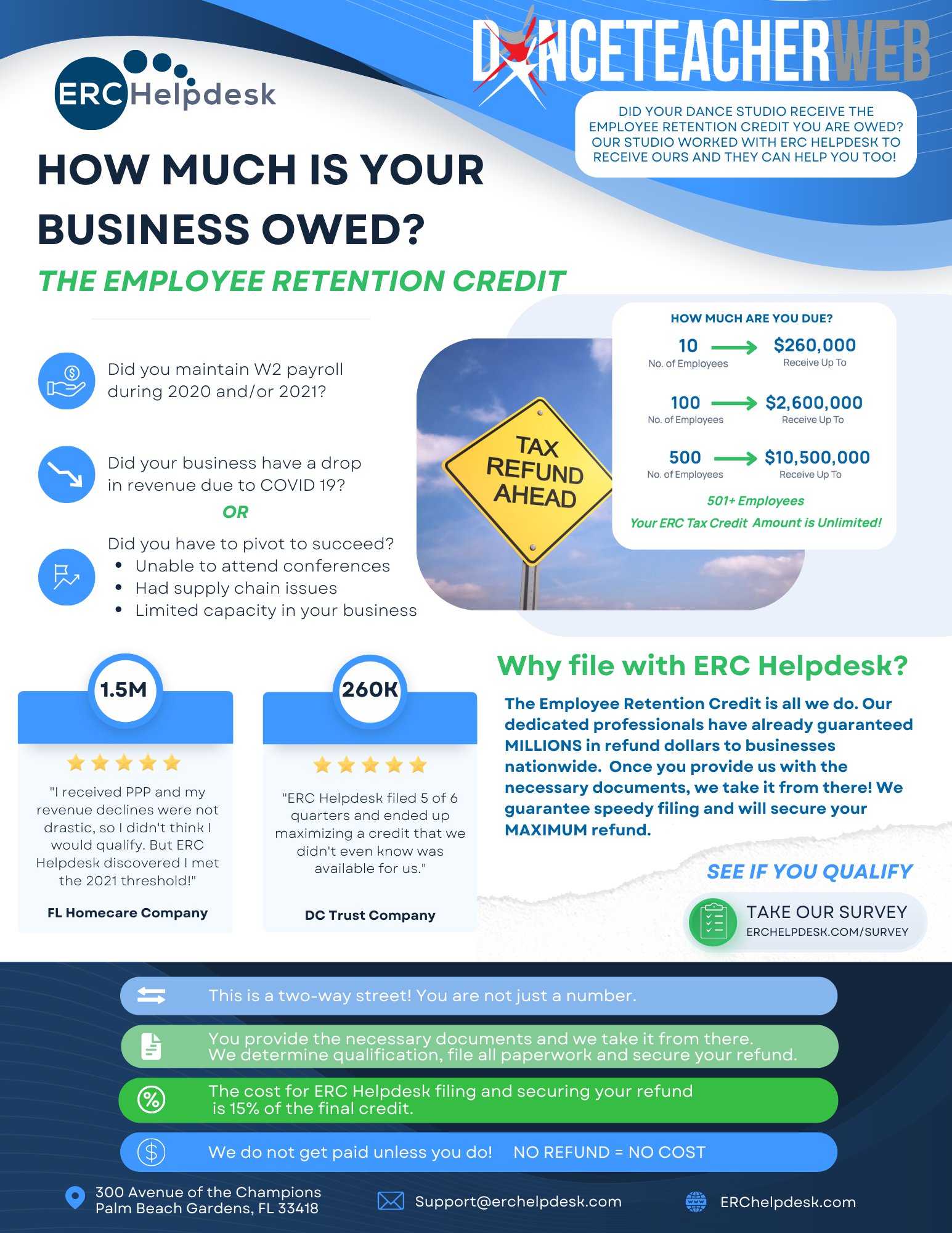

The Employee Retention Credit Program has been extended a whole year! You can now continue to apply for all six quarters (Quarters 2,3,4 of 2020 and 1,2,3 of 2021) until quarter 2 of 2024.

Steve and Angela Sirico DTW founders and veteran studio owners recently received a substantial cash refund from the Employee Retention Tax Credit.

It doesn't matter if your employees are part time or full time. If they are W-2 then you can apply for this tax credit refund!

Dance studios in the USA that kept employees on payroll during the 2020-2021 Covid pandemic, and resulting government shutdowns, could be eligible for a substantial tax credit - up to $26,000 per employee!

This is an IRS Covid business stimulus program put in place to help all small business owners. Because almost all dance studios will have suffered from social-distancing restrictions, resulting in significant loss or revenue - you are eligible for the ERC.. even if you already claimed PPP!

Frequently asked questions...

Is this legit? Yes it is and all small business who retained W-2 employees during the pandemic can qualify, even if you had 2 rounds of PPP! DTW founder and studio owner Steve Sirico applied and their studio has already received a large cash refund.

Will this raise a red flag with the IRS? NO, the IRS is only a vessel for distributing the funds that are part of the CARES Act that was put in place by Congress. These funds are available and waiting to be claimed but you must apply to receive them.

Can my accountant do this? Yes they can, but with tax season in full swing they are most likely not going to have time and may not know all of the details. At the ERC Helpdesk this is all they do.

How can I find out more before I apply? We did a webinar a few months ago on how this program works. Watch the video replay below to learn more!

Apply Now to See If You Qualify by CLICKING HERE